By Our Correspondent

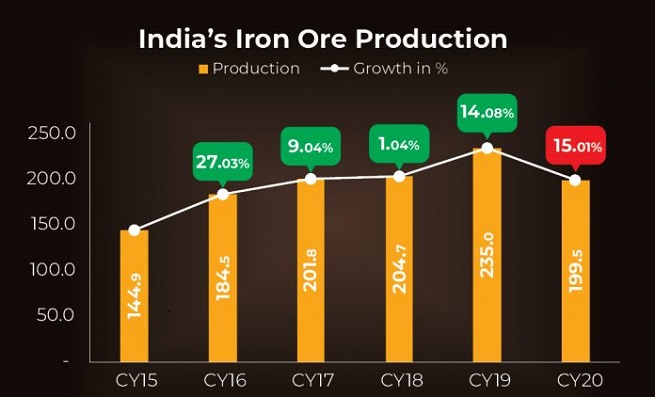

BHUBANESWAR/JODA/KOIRA: Odisha took credit for the biggest chunk of the country’s iron ore production at 109.5 MnT or 54.9% in CY20 which accounts for more than half of India’s total iron ore production. But compared to CY19, in 2020, Odisha’s contribution to India’s total iron ore production decreased 18.28%.

One of the key reasons behind the fall in Odisha’s iron ore production is that a lot of time was taken up in exchanging ownership of the auctioned mining leases. Chhattisgarh’s iron ore production dropped to 31.8 MnT in CY20, against 36 MnT in CY19.Karnataka’s production volume dropped to 28.33 MnT in CY20, compared to 31 MnT in CY19 while Jharkhand’s production reportedly dropped to 24.70 MnT in CY20 against 27 MnT in CY19.

National Mineral Development Corporation (NMDC) Limited, India’s largest iron ore producing company, recorded 31 MnT of production in CY20. Steel Authority of India Limited (SAIL) produced around 28.5 MnT of iron ore from its captive mines in the year under review. In comparison to CY19, SAIL’s production volume decreased 1.72%.

Captive miner Tata Steel increased its iron ore production by 12% from 25 MnT in CY19 to 28 MnT in CY20. However, India’s largest private merchant miner, Odisha-based Rungta Mines’ production dropped 50% from 28 MnT reported in CY19 to 14 MnT in CY20. In CY20, Rungta Mines secured the top spot by exporting 8.9 MnT of iron ore. Compared to CY19, the company’s iron ore exports increased 113% in CY20. S.M. Niryat is in the second spot with exports of 5.91 MnT followed by Jindal Steel & Power at 3.14 MnT. Interestingly, Odisha-based Kashvi Power & Steel Private Limited’s exports grew by a whopping 90% to 2.58 MnT last year from 1.36 MnT in CY19.

Odisha-based miners remained very active in liquidating their low-grade stocks. Iron ore exports from Odisha increased as 19 mining leases, which were put up for auction, were busy liquidating their inventories. The auctioned mining leases had roughly 40 MnT of inventory.

Paradip remained the largest iron ore exporting port in CY20. This year, the port’s iron ore exports increased 59% to around 20.98 MnT against CY19’s 13.22 MnT. Vishakhapatnam Port is in second spot at 7.37 MnT and Gopalpur Port in third, with around 5.67 MnT.

Around 63% of the total iron ore and pellets imported were by AM/NS India (a joint venture between ArcelorMittal and Nippon Steel), whereas the remaining small quantities were imported by Mono Steel and JSW Steel. Hazira Port, located in Gujarat, witnessed the highest iron ore import volumes of around 0.33 MnT in CY20. Kandla Port was the second-largest importer at 0.20 MnT. Other ports observed very small quantities of iron ore imports.

The average annual prices of Odisha’s iron ore lumps of Fe63% (5-18mm) grade were at INR 5,300/MT in CY20, against INR 3,971/MT reported in CY19.The highest price was recorded in the month of December at INR 8,800/MT, while the lowest price was observed in May-June at around INR 3,450/MT.The average annual price of Odisha’s iron ore fines of Fe63% were at INR 3,200/MT. Prices peaked at INR 6,500/MT during mid-November, while the lowest was observed during May-June at INR 1,900/MT.In CY20, pellets prices skyrocketed, touching their peak in the last week of December. Ex-Barbil prices hit INR 11,950/MT while around the same time ex-Raipur prices touched INR 11,525/MT and Durgapur’s, INR 12,075/MT.

However, with gradual unlocking measures adopted in India, steel demand picked up, resulting in improved domestic pellets usage. Pellets prices in the domestic market surged, backed by tight availability of high-grade iron ore in Odisha, as the majority of auctioned mining leases were still struggling to resume production. Domestic pellets prices for Barbil increased from INR 5,625/MT (loaded to wagons) in June 2020 to INR 11,095/MT in December, 2020.